14 Sep Coinbase Coin so you can Launch twenty-four 7 Bitcoin BTC and you will Ethereum ETH Futures Exchange regarding the You S.

To quit getting physical delivery of one’s root advantage, you’ll likely need to intimate your situation prior to conclusion. Certain agents provides elements positioned to take action automatically if we would like to keep your position right up until they ends. Attempt to account for unstable rate movement for the the past trading day of rough oil futures, otherwise propane futures, for example. And as We’ve along with told me, the fresh widescale availability of power adds a lot more risk.

Beginning a great futures condition concerns choosing whether to go a lot of time or quick, which translates to either buy to open otherwise sell to unlock. When you’re futures are a good equipment to have enterprises and you may cutting-edge traders, really shopping investors are more effective of that have a simple buy-and-hold strategy that will not require a margin account. If your security on your status drops below the broker’s margin requirements, you’ll be required to render more cash to your account to meet the repair margin.

Enable your current be the cause of futures trade

- This type of trading can be quite advanced, therefore it is wise to conduct generous research before getting inside.

- Inside condition, the newest individual carrying the fresh offer up to termination manage get delivery away from the underlying asset.

- They are influenced by the newest macroeconomic and you will geopolitical landscape, supply- and consult-related development, industry-specific advancements and the like.

Techniques including Span want tricky actual-time calculations you to definitely take several items into account such as volatility, decreases over time in order to expiration, hit costs and chance-free rates. A few popular margin computation strategies to have futures exchange try Period (Fundamental Collection Research of Chance) and you will Reg T (Regulation T). Duration are a methodology one to works out margin conditions centered on assessments of international one-day collection risk, rather than that of private positions. Reg T determines the fresh portion of the price out of a security a trader could possibly get borrow from a trading area (the newest Federal Reserve Panel features place maximum during the fifty%). There are a few points one to subscribe to the brand new difficulty of your futures business, such as the entry to leverage and you can termination times.

To ensure You to Choose For every Individual, Excite Range from the Pursuing the Info

Large firms can use futures as the a good hedge contrary to the hidden asset’s rates motions, the spot where the point is to end loss of rising prices. Usually, these businesses you want large amounts away from specific products in their development or production process to make their issues or to perform. Futures deals are standard by the number, high quality, and investment birth, making trading him or her for the futures transfers you can. It join the customer to purchasing and also the most other people to offering an inventory or shares inside a catalog at the a formerly fixed time and you will price.

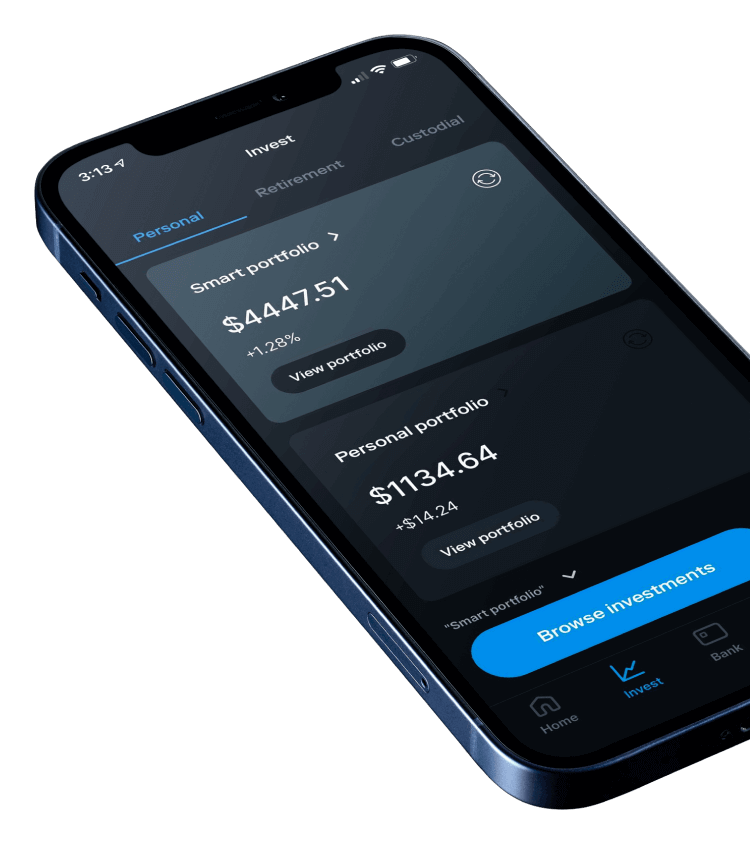

Recently, the fresh pub might have been increased rather so far as trading platforms are concerned. Now, buyers predict your platform getting just one area away from get in touch with along with your organization, where they are able to register, score confirmed, deposit https://lp2.smart-acc.com/5-best-you-fx-brokers-in-the-2025-compare-forex-agents/ /withdraw, trading, and you can perform its accounts all the from the exact same user interface. As the crypto landscape will continue to evolve, the expansion to the regulated perpetual futures trade underscores a’s move to your compliance-motivated development, paving the way to possess broader use from the financial market.

A product futures bargain is actually an agreement to shop for or offer a fixed quantity of specific commodity during the certain speed for the a particular go out. Like all futures agreements, product futures are often used to hedge or protect a good investment status or to bet on the newest directional way of one’s hidden advantage. As well, investors should understand you to definitely futures trade is going to be fairly state-of-the-art and you can it will trigger overleveraging.

The good news is there are plenty of enterprises available that permit the new trade out of futures agreements, very buyers have a great risk of looking a strong you to will meet their demands. It is because these traders (such as scalpers) are focused on exploiting quick rates motions inside very rigid timescales. Technology analysis allows these to pick short-name style, patterns, and you will speed motion which may help him or her make successful trading behavior. However, researching futures themselves is certainly one part of the knowledge processes. To properly trade such derivatives, one to must also have an audio knowledge of what moves the values of the hidden possessions. Futures agreements specify times if the arrangement ends and in case bodily birth of your underlying investment is born.

Just what Affects Futures Costs?

People exposure shedding over the original margin amount due to the new influence utilized in futures. Buyers may also take a preliminary speculative status when they expect the price usually fall. In case your price refuses, the brand new investor takes an offsetting reputation to shut the fresh deal. An investor progress should your hidden asset’s price is underneath the offer price and you will seems to lose if the newest price is above the bargain rates. When the an investor purchases an excellent futures offer and also the rates goes up above the brand-new bargain rate during the expiration, there is certainly money. Yet not, the brand new individual could also remove in case your commodity’s rate is straight down compared to purchase price specified on the futures package.

If the investors believe a specific security is born for an autumn and sell a great futures bargain, and the business declines affirmed, buyers can buy right back the fresh package for less, profiting from the difference. Futures try contracts to find otherwise offer a specific fundamental asset at the the next go out. The underlying resource will likely be a product, a safety, and other financial tool. Futures trading requires the client to purchase or even the merchant in order to sell the underlying investment at the put speed, regardless of the market price, in the conclusion day. By the correctly forecasting rate movements, investors is build generous productivity, even after a relatively quick 1st investment, as a result of the leveraged characteristics out of futures exchange.

Since the an agreement nears expiration, investors who would like to manage a situation generally roll over to help you the next offered deal day. Short-name buyers usually focus on front side-week contracts, while you are long-label people looks subsequent away. Considering the large volatility out of cryptocurrencies, continuous futures enable it to be investors so you can exploit price shifts without having to worry in the deal expirations.

He was stating optimism to the gains possible of your world from the recently ended White House Crypto Seminar. Additionally, that it advancement happens in the middle of growing scrutiny out of unregistered crypto derivatives trade in the usa. Giving a managed solution, it can fill a life threatening pit on the market when you’re making sure adherence to economic laws and regulations. Program response and membership access moments may differ because of an excellent sort of things, as well as trading amounts, business criteria, program results, and other items. On this page, we’ll assist you in finding out-by bringing a closer look in the just what futures is as well as how they work. To possess suggestions around the newest subscription reputation of eleven Monetary, excite contact the state securities authorities for those states where 11 Monetary keeps a subscription filing.

All of the possessions root futures talks about sets from farming items so you can economic indexes. As of early 2024, the most traded futures was within the equities (65% away from futures change by the volume), currencies (9%), interest rates (9%), times (5%), agriculture (4%), and gold and silver coins (4%). Very first, we’ll put down some very important distinctions for forward and you may futures agreements prior to embracing who spends him or her and also the types of root property frequently from the gamble. A good futures deal allows the parties to buy or sell a good particular fundamental investment from the a flat upcoming time. The root advantage will be a commodity, a protection, or other economic tool. You could routine trading having “paper money” before you commit real bucks for the first trading.

Views, market analysis, and you may suggestions is actually susceptible to change when. It’s also imperative to control your margin standards and you may display account equilibrium transform. Monitor the afternoon P/L (each day funds otherwise losings) and you will Discover P/L (full money or loss because the reputation is exposed) to be sure you have enough guarantee.

A forward bargain ‘s the eldest sort of these agreements, predating the fresh trade inside futures one to formalized “to reach” agreements from the latter half the new nineteenth century. A forward is a binding agreement ranging from a couple events to help you interact within the the long term, with one party using the enough time status and the second delivering the fresh small status; also they are known as long and short ahead. Pattern supporters song prevalent market style by purchasing during the rate uptrends and promoting through the downtrends. This method hinges on symptoms such swinging averages, moving average crossovers (including a “Golden Cross”), and you may trendlines to determine when to go into and you will log off positions. Futures deals give you the potential to do chance from the anticipating next situations that can changes field costs. It large control lets buyers to get higher payouts insurance firms quicker security.

Sorry, the comment form is closed at this time.